User login

Child of The New Gastroenterologist

Staying financially well in the time of COVID-19

As COVID-19 continues to threaten the United States and the world, individuals in every profession have been challenged to examine their financial situation. At Fidelity Investments, we recently conducted a national survey asking people how current events have affected their opinions and behaviors when it comes to their money. The results showed that six in 10 Americans are concerned about household finances over the next 6 months. Unfortunately, we’ve seen that even health care professionals have not been financially spared, with salaries or benefits cut or, worse, furloughs and layoffs as hospital systems struggle. I work with many physicians, including gastroenterologists, in my role as a wealth planner for Fidelity Investments and have received quite a few questions related to shoring up family finances during these difficult times.

Luckily, the financial best practices that I share in “good” times ring true even in today’s world, with a few additions given the health and economic risks created by COVID-19.

1. Review your budget. It’s one thing to know that your budget is generally balanced (the dollars you spend are less than the dollars you earn). But it’s worth taking a closer look to see just where those dollars are going. In times of uncertainty, cutting back on expenses that aren’t necessary or don’t provide meaningful value to your life can be worthwhile. If you or your family have lost income because of the pandemic, you might consider these seven simple tips to help boost your cash flow.

2. Tackle (or find relief from) student loan debt. Doctors today graduate medical school with a median debt of just under $195,000.1 Repaying these loans is daunting, particularly during the COVID-19 crisis. The recent passing of the CARES Act recognizes these difficult times: in fact, it automatically suspended required minimum loan payments and interest accrual on federal student loans until Sept. 30, 2020. This only applies to federal student loans, not private student loans. Beyond this period, if you are still struggling with payments, you may explore the possibility of refinancing, by taking out a lower-interest private loan and using that to pay off student loans (although this may extend the life of your loan). Borrowers could also consider other programs, such as REPAYE (Revised Pay As You Earn) through which your monthly payment tops out at 10% of your monthly income, or Public Service Loan Forgiveness (PSLF) if you work for a not-for-profit hospital or other qualifying employer. This program forgives the remaining balance on your direct loans after you have made 120 qualifying monthly payments while working full-time for a qualifying employer.

Additionally, borrowers could look for opportunities to reduce accrued interest, either by refinancing to a lower rate or making payments every 2 weeks rather than once each month.

3. Evaluate your emergency fund. It’s a good idea to keep 3-6 months’ of essential expenses in cash or cash-like investments. If you don’t yet have this 3- to 6-month cushion saved, now is a good time to work to reduce your expenses and stash away any extra cash.

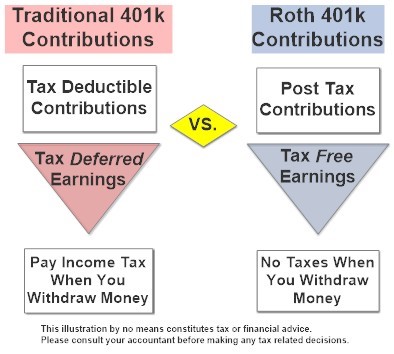

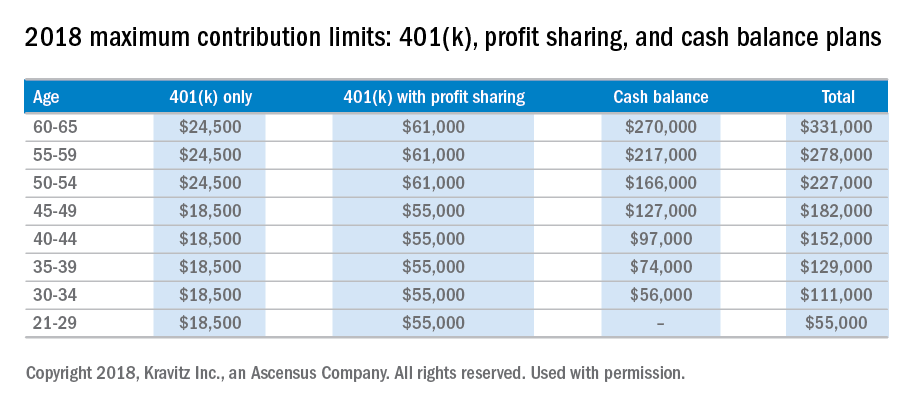

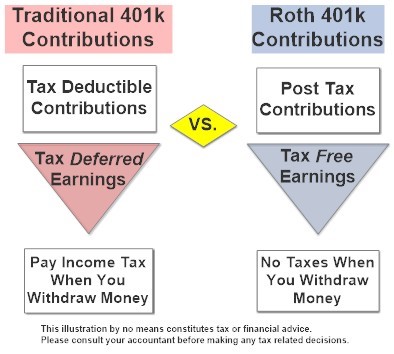

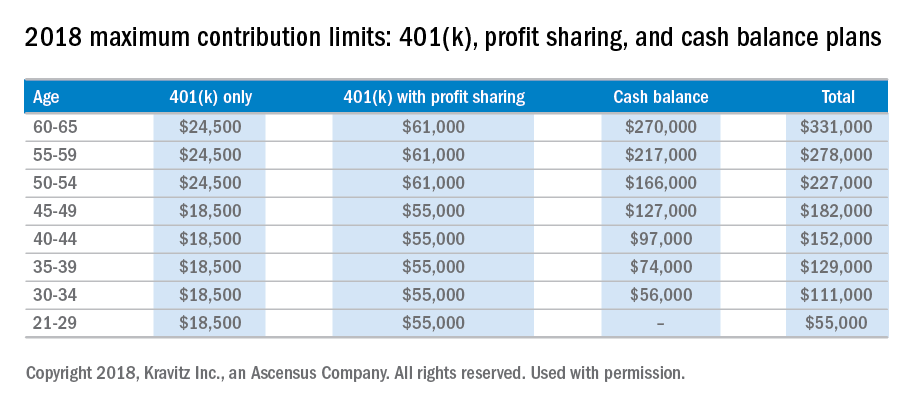

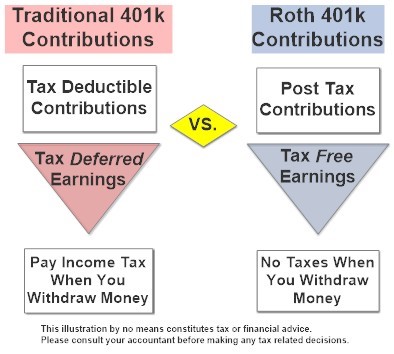

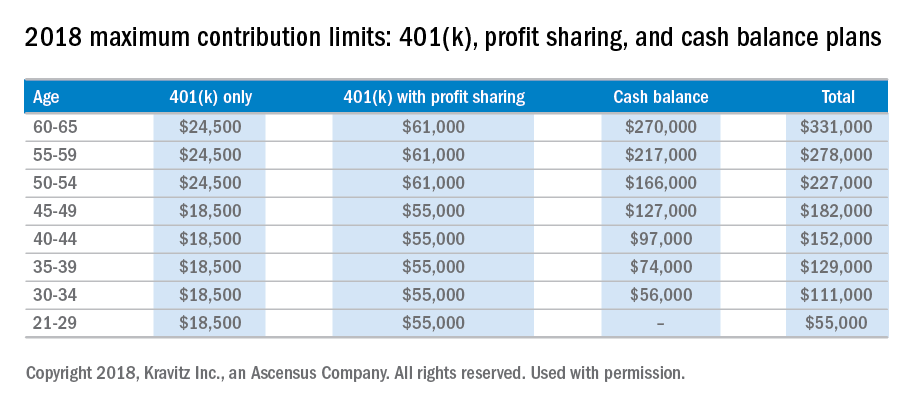

4. Save early and often for retirement. You can borrow money to support many of life’s needs, from housing, to cars, to college. But you can’t borrow for retirement. That is why I encourage clients to put retirement savings at the top of the list, after accounting for day-to-day needs of their families. People often ask me whether it makes sense to continue saving for retirement, often a far-off goal for younger doctors, especially in these uncertain times. My answer? Yes. If you are able to save, continue to save: the earlier you begin to make contributions to your retirement account, and the longer you continue to do so, the more your retirement account(s) have the potential to grow over time.

Another question I receive is whether to take distributions from a retirement account early if you find yourself in a precarious financial situation because of the COVID-19 crisis. The CARES Act provides options allowing Americans to take a withdrawal or loan from a participating retirement plan if you, your spouse, or your dependent have a COVID-19 related illness or you’re experiencing a loss of income related to the COVID-19 pandemic. Try to look at alternative sources of income before tapping your hard-earned retirement savings. If you can find a way to continue saving and avoid drawing down your retirement accounts, your future self will thank you.

5. If you have a high-deductible health plan that offers it, explore a Health Savings Account (HSA). One of the most important factors in a solid financial plan is knowing how to pay for health care expenses, both now and as we age. HSAs are a tax-advantaged account that can be used to save money for qualified medical expenses. They are considered to provide a “triple-tax advantage” since contributions, qualified withdrawals, and investment growth are all tax-free.2 The dollars in these accounts can stay there over time, so in years with low expenses you could use these to save for health care in retirement, while in other years they can be used to pay necessary medical bills. HSAs require the participant to be enrolled in a high-deductible health plan, so you would first need to verify that your employer provides this option.

6. Be prepared to protect yourself, your practice, and your family. Typically, I encourage the medical professionals I work with to review their current insurance plans (such as disability, life, and malpractice) to determine whether they have the right levels of coverage for their situation. With COVID-19 layered on top of the usual level of risk, it’s important to consider reviewing or updating other key elements of your family’s plan, like your health care proxies and a living will.

7. Put your income to work. When your disposable income grows, and you’ve covered all of the foundational elements of a financial plan (a rainy-day fund, contingency planning for health care costs, and so on), it might be the right time to consider investing for something other than retirement. As you do that, be sure you are invested in a diversified strategy with a balance of risk and return that is comfortable for you.

Recent market volatility can bring nerves that make it difficult to stay invested. However, as long as your risk tolerance and time horizon reflect your asset allocation – the mix of stock, bonds, and cash (which a financial planner can help with) – you can take comfort in knowing that historically every severe downturn has eventually given way to further growth.

During uncertain times like these, I think the best guidance is to focus on what you can control. The considerations above are a great place to start building a financial plan to solidify you and your family’s future. A Fidelity survey found that 44% of Americans are now working to build up their emergency savings, and one-third (34%) are rethinking how they manage their money because of the COVID-19 crisis.3 Despite the stresses we all face, there is no time like the present to start or revisit your financial plan.

Footnotes

1. Barron D. Why Doctors Are Drowning in Medical School Debt. Scientific American. July 15, 2019.

2. With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation. The triple tax advantages are only applicable if the money is used to pay for qualified medical expenses as described in IRS Publication 969.

3. Fidelity Market Sentiment Study presents the findings of a nationwide online survey consisting of 3,012 adults, at least 18 years of age, from which 1,591 respondents qualified as having at least one investment account. The study was fielded April 1-8, 2020, by ENGINE INSIGHTS, an independent research firm not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. For the purposes of this study, the generations are defined as follows: Millennials (aged 24-39 years); Generation X (aged 40-55 years); Baby Boomers (aged 56-74 years).

Mr. Tudor is Vice President, Wealth Planning Consultant at Fidelity Investments.

As COVID-19 continues to threaten the United States and the world, individuals in every profession have been challenged to examine their financial situation. At Fidelity Investments, we recently conducted a national survey asking people how current events have affected their opinions and behaviors when it comes to their money. The results showed that six in 10 Americans are concerned about household finances over the next 6 months. Unfortunately, we’ve seen that even health care professionals have not been financially spared, with salaries or benefits cut or, worse, furloughs and layoffs as hospital systems struggle. I work with many physicians, including gastroenterologists, in my role as a wealth planner for Fidelity Investments and have received quite a few questions related to shoring up family finances during these difficult times.

Luckily, the financial best practices that I share in “good” times ring true even in today’s world, with a few additions given the health and economic risks created by COVID-19.

1. Review your budget. It’s one thing to know that your budget is generally balanced (the dollars you spend are less than the dollars you earn). But it’s worth taking a closer look to see just where those dollars are going. In times of uncertainty, cutting back on expenses that aren’t necessary or don’t provide meaningful value to your life can be worthwhile. If you or your family have lost income because of the pandemic, you might consider these seven simple tips to help boost your cash flow.

2. Tackle (or find relief from) student loan debt. Doctors today graduate medical school with a median debt of just under $195,000.1 Repaying these loans is daunting, particularly during the COVID-19 crisis. The recent passing of the CARES Act recognizes these difficult times: in fact, it automatically suspended required minimum loan payments and interest accrual on federal student loans until Sept. 30, 2020. This only applies to federal student loans, not private student loans. Beyond this period, if you are still struggling with payments, you may explore the possibility of refinancing, by taking out a lower-interest private loan and using that to pay off student loans (although this may extend the life of your loan). Borrowers could also consider other programs, such as REPAYE (Revised Pay As You Earn) through which your monthly payment tops out at 10% of your monthly income, or Public Service Loan Forgiveness (PSLF) if you work for a not-for-profit hospital or other qualifying employer. This program forgives the remaining balance on your direct loans after you have made 120 qualifying monthly payments while working full-time for a qualifying employer.

Additionally, borrowers could look for opportunities to reduce accrued interest, either by refinancing to a lower rate or making payments every 2 weeks rather than once each month.

3. Evaluate your emergency fund. It’s a good idea to keep 3-6 months’ of essential expenses in cash or cash-like investments. If you don’t yet have this 3- to 6-month cushion saved, now is a good time to work to reduce your expenses and stash away any extra cash.

4. Save early and often for retirement. You can borrow money to support many of life’s needs, from housing, to cars, to college. But you can’t borrow for retirement. That is why I encourage clients to put retirement savings at the top of the list, after accounting for day-to-day needs of their families. People often ask me whether it makes sense to continue saving for retirement, often a far-off goal for younger doctors, especially in these uncertain times. My answer? Yes. If you are able to save, continue to save: the earlier you begin to make contributions to your retirement account, and the longer you continue to do so, the more your retirement account(s) have the potential to grow over time.

Another question I receive is whether to take distributions from a retirement account early if you find yourself in a precarious financial situation because of the COVID-19 crisis. The CARES Act provides options allowing Americans to take a withdrawal or loan from a participating retirement plan if you, your spouse, or your dependent have a COVID-19 related illness or you’re experiencing a loss of income related to the COVID-19 pandemic. Try to look at alternative sources of income before tapping your hard-earned retirement savings. If you can find a way to continue saving and avoid drawing down your retirement accounts, your future self will thank you.

5. If you have a high-deductible health plan that offers it, explore a Health Savings Account (HSA). One of the most important factors in a solid financial plan is knowing how to pay for health care expenses, both now and as we age. HSAs are a tax-advantaged account that can be used to save money for qualified medical expenses. They are considered to provide a “triple-tax advantage” since contributions, qualified withdrawals, and investment growth are all tax-free.2 The dollars in these accounts can stay there over time, so in years with low expenses you could use these to save for health care in retirement, while in other years they can be used to pay necessary medical bills. HSAs require the participant to be enrolled in a high-deductible health plan, so you would first need to verify that your employer provides this option.

6. Be prepared to protect yourself, your practice, and your family. Typically, I encourage the medical professionals I work with to review their current insurance plans (such as disability, life, and malpractice) to determine whether they have the right levels of coverage for their situation. With COVID-19 layered on top of the usual level of risk, it’s important to consider reviewing or updating other key elements of your family’s plan, like your health care proxies and a living will.

7. Put your income to work. When your disposable income grows, and you’ve covered all of the foundational elements of a financial plan (a rainy-day fund, contingency planning for health care costs, and so on), it might be the right time to consider investing for something other than retirement. As you do that, be sure you are invested in a diversified strategy with a balance of risk and return that is comfortable for you.

Recent market volatility can bring nerves that make it difficult to stay invested. However, as long as your risk tolerance and time horizon reflect your asset allocation – the mix of stock, bonds, and cash (which a financial planner can help with) – you can take comfort in knowing that historically every severe downturn has eventually given way to further growth.

During uncertain times like these, I think the best guidance is to focus on what you can control. The considerations above are a great place to start building a financial plan to solidify you and your family’s future. A Fidelity survey found that 44% of Americans are now working to build up their emergency savings, and one-third (34%) are rethinking how they manage their money because of the COVID-19 crisis.3 Despite the stresses we all face, there is no time like the present to start or revisit your financial plan.

Footnotes

1. Barron D. Why Doctors Are Drowning in Medical School Debt. Scientific American. July 15, 2019.

2. With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation. The triple tax advantages are only applicable if the money is used to pay for qualified medical expenses as described in IRS Publication 969.

3. Fidelity Market Sentiment Study presents the findings of a nationwide online survey consisting of 3,012 adults, at least 18 years of age, from which 1,591 respondents qualified as having at least one investment account. The study was fielded April 1-8, 2020, by ENGINE INSIGHTS, an independent research firm not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. For the purposes of this study, the generations are defined as follows: Millennials (aged 24-39 years); Generation X (aged 40-55 years); Baby Boomers (aged 56-74 years).

Mr. Tudor is Vice President, Wealth Planning Consultant at Fidelity Investments.

As COVID-19 continues to threaten the United States and the world, individuals in every profession have been challenged to examine their financial situation. At Fidelity Investments, we recently conducted a national survey asking people how current events have affected their opinions and behaviors when it comes to their money. The results showed that six in 10 Americans are concerned about household finances over the next 6 months. Unfortunately, we’ve seen that even health care professionals have not been financially spared, with salaries or benefits cut or, worse, furloughs and layoffs as hospital systems struggle. I work with many physicians, including gastroenterologists, in my role as a wealth planner for Fidelity Investments and have received quite a few questions related to shoring up family finances during these difficult times.

Luckily, the financial best practices that I share in “good” times ring true even in today’s world, with a few additions given the health and economic risks created by COVID-19.

1. Review your budget. It’s one thing to know that your budget is generally balanced (the dollars you spend are less than the dollars you earn). But it’s worth taking a closer look to see just where those dollars are going. In times of uncertainty, cutting back on expenses that aren’t necessary or don’t provide meaningful value to your life can be worthwhile. If you or your family have lost income because of the pandemic, you might consider these seven simple tips to help boost your cash flow.

2. Tackle (or find relief from) student loan debt. Doctors today graduate medical school with a median debt of just under $195,000.1 Repaying these loans is daunting, particularly during the COVID-19 crisis. The recent passing of the CARES Act recognizes these difficult times: in fact, it automatically suspended required minimum loan payments and interest accrual on federal student loans until Sept. 30, 2020. This only applies to federal student loans, not private student loans. Beyond this period, if you are still struggling with payments, you may explore the possibility of refinancing, by taking out a lower-interest private loan and using that to pay off student loans (although this may extend the life of your loan). Borrowers could also consider other programs, such as REPAYE (Revised Pay As You Earn) through which your monthly payment tops out at 10% of your monthly income, or Public Service Loan Forgiveness (PSLF) if you work for a not-for-profit hospital or other qualifying employer. This program forgives the remaining balance on your direct loans after you have made 120 qualifying monthly payments while working full-time for a qualifying employer.

Additionally, borrowers could look for opportunities to reduce accrued interest, either by refinancing to a lower rate or making payments every 2 weeks rather than once each month.

3. Evaluate your emergency fund. It’s a good idea to keep 3-6 months’ of essential expenses in cash or cash-like investments. If you don’t yet have this 3- to 6-month cushion saved, now is a good time to work to reduce your expenses and stash away any extra cash.

4. Save early and often for retirement. You can borrow money to support many of life’s needs, from housing, to cars, to college. But you can’t borrow for retirement. That is why I encourage clients to put retirement savings at the top of the list, after accounting for day-to-day needs of their families. People often ask me whether it makes sense to continue saving for retirement, often a far-off goal for younger doctors, especially in these uncertain times. My answer? Yes. If you are able to save, continue to save: the earlier you begin to make contributions to your retirement account, and the longer you continue to do so, the more your retirement account(s) have the potential to grow over time.

Another question I receive is whether to take distributions from a retirement account early if you find yourself in a precarious financial situation because of the COVID-19 crisis. The CARES Act provides options allowing Americans to take a withdrawal or loan from a participating retirement plan if you, your spouse, or your dependent have a COVID-19 related illness or you’re experiencing a loss of income related to the COVID-19 pandemic. Try to look at alternative sources of income before tapping your hard-earned retirement savings. If you can find a way to continue saving and avoid drawing down your retirement accounts, your future self will thank you.

5. If you have a high-deductible health plan that offers it, explore a Health Savings Account (HSA). One of the most important factors in a solid financial plan is knowing how to pay for health care expenses, both now and as we age. HSAs are a tax-advantaged account that can be used to save money for qualified medical expenses. They are considered to provide a “triple-tax advantage” since contributions, qualified withdrawals, and investment growth are all tax-free.2 The dollars in these accounts can stay there over time, so in years with low expenses you could use these to save for health care in retirement, while in other years they can be used to pay necessary medical bills. HSAs require the participant to be enrolled in a high-deductible health plan, so you would first need to verify that your employer provides this option.

6. Be prepared to protect yourself, your practice, and your family. Typically, I encourage the medical professionals I work with to review their current insurance plans (such as disability, life, and malpractice) to determine whether they have the right levels of coverage for their situation. With COVID-19 layered on top of the usual level of risk, it’s important to consider reviewing or updating other key elements of your family’s plan, like your health care proxies and a living will.

7. Put your income to work. When your disposable income grows, and you’ve covered all of the foundational elements of a financial plan (a rainy-day fund, contingency planning for health care costs, and so on), it might be the right time to consider investing for something other than retirement. As you do that, be sure you are invested in a diversified strategy with a balance of risk and return that is comfortable for you.

Recent market volatility can bring nerves that make it difficult to stay invested. However, as long as your risk tolerance and time horizon reflect your asset allocation – the mix of stock, bonds, and cash (which a financial planner can help with) – you can take comfort in knowing that historically every severe downturn has eventually given way to further growth.

During uncertain times like these, I think the best guidance is to focus on what you can control. The considerations above are a great place to start building a financial plan to solidify you and your family’s future. A Fidelity survey found that 44% of Americans are now working to build up their emergency savings, and one-third (34%) are rethinking how they manage their money because of the COVID-19 crisis.3 Despite the stresses we all face, there is no time like the present to start or revisit your financial plan.

Footnotes

1. Barron D. Why Doctors Are Drowning in Medical School Debt. Scientific American. July 15, 2019.

2. With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation. The triple tax advantages are only applicable if the money is used to pay for qualified medical expenses as described in IRS Publication 969.

3. Fidelity Market Sentiment Study presents the findings of a nationwide online survey consisting of 3,012 adults, at least 18 years of age, from which 1,591 respondents qualified as having at least one investment account. The study was fielded April 1-8, 2020, by ENGINE INSIGHTS, an independent research firm not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. For the purposes of this study, the generations are defined as follows: Millennials (aged 24-39 years); Generation X (aged 40-55 years); Baby Boomers (aged 56-74 years).

Mr. Tudor is Vice President, Wealth Planning Consultant at Fidelity Investments.

So you want to be an expert witness?

Acting as an expert witness in a legal matter can be a nice way to compliment your practice. However, it is important to understand the role of experts, as well as their duties and obligations. Expert witnesses are called to testify on the basis of their specialized knowledge, not necessarily their direct knowledge of events and issues in the case.

Medical experts often play an important role in the evaluation, development, and preparation of a case long before it ever goes to trial. In some states, to even file a medical malpractice complaint a plaintiff is required to have the case evaluated by an expert and obtain a written report outlining why the plaintiff has a reasonable and meritorious cause for filing such an action.

There are different types of expert witness testimony. Experts can give opinion testimony as a physician who provided treatment to the plaintiff and whose conduct is not at issue. The second type of expert witness is a retained or controlled expert witness. This is a person giving opinion testimony after being retained by a lawyer on behalf of one of the parties to the lawsuit.

Before you give deposition or trial testimony, your opinions must be disclosed in writing and provided to the other parties in the case. In federal court, this is governed by Federal Rule of Civil Procedure 26. If the case is pending in state court, your written opinions are governed by local court rules. In both cases, the written opinions should be thorough and complete because you will not be allowed to testify to new opinions at the time of trial but will generally be allowed to expand upon those disclosed in writing at your deposition trial.

In order for a jury to hear your opinions at trial, your opinions must be reliable. In federal court, expert testimony is governed by Federal Rule of Evidence 702, which states:

A witness who is qualified as an expert by knowledge, skill, experience, training, or education may testify in the form of an opinion or otherwise if:

a) the expert’s scientific, technical, or other specialized knowledge will help the trier of fact to understand the evidence or to determine a fact in issue;

b) the testimony is based on sufficient facts or data;

c) the testimony is the product of reliable principles and methods; and

d) the expert has reliably applied the principles and methods to the facts of the case.

This means, that if a fact or evidence at issue involves scientific, technical, or specialized knowledge that is outside the scope of an ordinary layman’s experience, or involves complex issues challenging a layman’s comprehension, expert testimony is required. The scientific evidence must not just be relevant but also reliable. Expert opinions will be scrutinized to see if they are based on scientific testing or review of scientific data rather than just assumptions or speculation. Additionally, the experts must be qualified by their knowledge, skill, experience, training, or education. Given these parameters, it should come as no surprise that expert trial testimony is required for all medical malpractice cases.

Some states follow the “new or novel rule” which dictates that expert testimony is only admissible if the methodology or scientific principal on which the opinion is based is sufficiently established to have gained general acceptance in the particular field in which it belongs. This means that the evidence must be generally accepted as reliable in the relevant scientific community. New or novel techniques will be placed under the scrutiny of this standard. Courts will look at papers, books, journals, and case law to make a determination as to the reliability and general acceptance. Failure to meet the requisite standards may render a physician ineligible to testify.

If you are considering acting as an expert witness there are a few basic dos and don’ts to keep in mind:

Do be mindful of your criticism. If testifying in a medical malpractice case, you will be giving sworn testimony as to whether another physician deviated from the standard of care. Be aware that your testimony can later be used against you if your conduct is ever at issue, or if you contradict yourself in another case. Attorneys often look for prior testimony to use when questioning you at deposition and trial.

Do be aware of any applicable professional society guidelines. Many professional societies publish ethical guidelines as it relates to expert medical testimony. Be aware of those and know that you may be asked about them, especially if you are a member of that society.

Do be prepared for basic areas of cross-examination. There are a few tried and true areas that will always be the subject of cross-examination. Any perceived bias you may have, your fees, and whether you do more work for plaintiffs versus defendants are a just few examples. You should also be prepared to be cross-examined on the differences between personal practice (what you do) and an actual deviation from the standard of care.

Do keep written communication to a minimum. All communication between the expert physician and the attorney is potentially discoverable by the other side. The rules differ for state and federal courts. Emails, draft reports, and written questions all cause the creation of unnecessary side issues and areas of cross-examination. The best practice is for all substantive communication to be done by phone.

Do be clear in what you are charging. It is not unusual for an expert to charge one hourly rate for record review, and a different rate for testimony. Your fee schedule should also note that any travel expenses you incur will also be invoiced. Your hourly rate should be appropriate for your area of practice. In our experience, gastroenterologists typically charge $400.00-$600.00 an hour for record review, and $550.00-$700.00 an hour for testimony.

Do not submit an invoice until after your deposition. Submitting invoices before your deposition creates unnecessary cross-examination issues. At the time of retention, speak to the attorney and ask if you will be able to submit invoices as you work. Most attorneys prefer invoices be submitted after your deposition. Because the wheels of justice often turn slowly, you could be waiting an equally long time to submit an invoice and get paid. One way to avoid this dilemma is to require a retainer at the time of retention.

Do not sign up with an expert finder service. Resist the urge to sign up with an expert finder service. The best medical experts come from referrals from other attorneys or physicians. Expert retention via an expert finder service creates the impression that you are a “hired gun” in the business of being a professional expert and can diminish your credibility. The finder services also charge a commission or fee.

As a gastroenterologist, you have the specialized knowledge to provide expert testimony regarding the cause of an injury and extent of damages in cases where you have treated a patient. You also have the type of education and training necessary to serve as an independent expert. Doing so is a serious task that can be time consuming and stressful. However, it can also be rewarding and allow you to make sure a fair and just outcome occurs.

This article is for general informational purposes only. Please consult your own attorney if you have questions. This information is not intended to create an attorney-client relationship.

Mr. Mills is an equity partner at Cunningham, Meyer & Vedrine PC in Chicago. Ms. Lindbert is a partner at Cunningham, Meyer & Vedrine PC. Both focus their practices on defending doctors and hospitals in medical malpractice actions.

Acting as an expert witness in a legal matter can be a nice way to compliment your practice. However, it is important to understand the role of experts, as well as their duties and obligations. Expert witnesses are called to testify on the basis of their specialized knowledge, not necessarily their direct knowledge of events and issues in the case.

Medical experts often play an important role in the evaluation, development, and preparation of a case long before it ever goes to trial. In some states, to even file a medical malpractice complaint a plaintiff is required to have the case evaluated by an expert and obtain a written report outlining why the plaintiff has a reasonable and meritorious cause for filing such an action.

There are different types of expert witness testimony. Experts can give opinion testimony as a physician who provided treatment to the plaintiff and whose conduct is not at issue. The second type of expert witness is a retained or controlled expert witness. This is a person giving opinion testimony after being retained by a lawyer on behalf of one of the parties to the lawsuit.

Before you give deposition or trial testimony, your opinions must be disclosed in writing and provided to the other parties in the case. In federal court, this is governed by Federal Rule of Civil Procedure 26. If the case is pending in state court, your written opinions are governed by local court rules. In both cases, the written opinions should be thorough and complete because you will not be allowed to testify to new opinions at the time of trial but will generally be allowed to expand upon those disclosed in writing at your deposition trial.

In order for a jury to hear your opinions at trial, your opinions must be reliable. In federal court, expert testimony is governed by Federal Rule of Evidence 702, which states:

A witness who is qualified as an expert by knowledge, skill, experience, training, or education may testify in the form of an opinion or otherwise if:

a) the expert’s scientific, technical, or other specialized knowledge will help the trier of fact to understand the evidence or to determine a fact in issue;

b) the testimony is based on sufficient facts or data;

c) the testimony is the product of reliable principles and methods; and

d) the expert has reliably applied the principles and methods to the facts of the case.

This means, that if a fact or evidence at issue involves scientific, technical, or specialized knowledge that is outside the scope of an ordinary layman’s experience, or involves complex issues challenging a layman’s comprehension, expert testimony is required. The scientific evidence must not just be relevant but also reliable. Expert opinions will be scrutinized to see if they are based on scientific testing or review of scientific data rather than just assumptions or speculation. Additionally, the experts must be qualified by their knowledge, skill, experience, training, or education. Given these parameters, it should come as no surprise that expert trial testimony is required for all medical malpractice cases.

Some states follow the “new or novel rule” which dictates that expert testimony is only admissible if the methodology or scientific principal on which the opinion is based is sufficiently established to have gained general acceptance in the particular field in which it belongs. This means that the evidence must be generally accepted as reliable in the relevant scientific community. New or novel techniques will be placed under the scrutiny of this standard. Courts will look at papers, books, journals, and case law to make a determination as to the reliability and general acceptance. Failure to meet the requisite standards may render a physician ineligible to testify.

If you are considering acting as an expert witness there are a few basic dos and don’ts to keep in mind:

Do be mindful of your criticism. If testifying in a medical malpractice case, you will be giving sworn testimony as to whether another physician deviated from the standard of care. Be aware that your testimony can later be used against you if your conduct is ever at issue, or if you contradict yourself in another case. Attorneys often look for prior testimony to use when questioning you at deposition and trial.

Do be aware of any applicable professional society guidelines. Many professional societies publish ethical guidelines as it relates to expert medical testimony. Be aware of those and know that you may be asked about them, especially if you are a member of that society.

Do be prepared for basic areas of cross-examination. There are a few tried and true areas that will always be the subject of cross-examination. Any perceived bias you may have, your fees, and whether you do more work for plaintiffs versus defendants are a just few examples. You should also be prepared to be cross-examined on the differences between personal practice (what you do) and an actual deviation from the standard of care.

Do keep written communication to a minimum. All communication between the expert physician and the attorney is potentially discoverable by the other side. The rules differ for state and federal courts. Emails, draft reports, and written questions all cause the creation of unnecessary side issues and areas of cross-examination. The best practice is for all substantive communication to be done by phone.

Do be clear in what you are charging. It is not unusual for an expert to charge one hourly rate for record review, and a different rate for testimony. Your fee schedule should also note that any travel expenses you incur will also be invoiced. Your hourly rate should be appropriate for your area of practice. In our experience, gastroenterologists typically charge $400.00-$600.00 an hour for record review, and $550.00-$700.00 an hour for testimony.

Do not submit an invoice until after your deposition. Submitting invoices before your deposition creates unnecessary cross-examination issues. At the time of retention, speak to the attorney and ask if you will be able to submit invoices as you work. Most attorneys prefer invoices be submitted after your deposition. Because the wheels of justice often turn slowly, you could be waiting an equally long time to submit an invoice and get paid. One way to avoid this dilemma is to require a retainer at the time of retention.

Do not sign up with an expert finder service. Resist the urge to sign up with an expert finder service. The best medical experts come from referrals from other attorneys or physicians. Expert retention via an expert finder service creates the impression that you are a “hired gun” in the business of being a professional expert and can diminish your credibility. The finder services also charge a commission or fee.

As a gastroenterologist, you have the specialized knowledge to provide expert testimony regarding the cause of an injury and extent of damages in cases where you have treated a patient. You also have the type of education and training necessary to serve as an independent expert. Doing so is a serious task that can be time consuming and stressful. However, it can also be rewarding and allow you to make sure a fair and just outcome occurs.

This article is for general informational purposes only. Please consult your own attorney if you have questions. This information is not intended to create an attorney-client relationship.

Mr. Mills is an equity partner at Cunningham, Meyer & Vedrine PC in Chicago. Ms. Lindbert is a partner at Cunningham, Meyer & Vedrine PC. Both focus their practices on defending doctors and hospitals in medical malpractice actions.

Acting as an expert witness in a legal matter can be a nice way to compliment your practice. However, it is important to understand the role of experts, as well as their duties and obligations. Expert witnesses are called to testify on the basis of their specialized knowledge, not necessarily their direct knowledge of events and issues in the case.

Medical experts often play an important role in the evaluation, development, and preparation of a case long before it ever goes to trial. In some states, to even file a medical malpractice complaint a plaintiff is required to have the case evaluated by an expert and obtain a written report outlining why the plaintiff has a reasonable and meritorious cause for filing such an action.

There are different types of expert witness testimony. Experts can give opinion testimony as a physician who provided treatment to the plaintiff and whose conduct is not at issue. The second type of expert witness is a retained or controlled expert witness. This is a person giving opinion testimony after being retained by a lawyer on behalf of one of the parties to the lawsuit.

Before you give deposition or trial testimony, your opinions must be disclosed in writing and provided to the other parties in the case. In federal court, this is governed by Federal Rule of Civil Procedure 26. If the case is pending in state court, your written opinions are governed by local court rules. In both cases, the written opinions should be thorough and complete because you will not be allowed to testify to new opinions at the time of trial but will generally be allowed to expand upon those disclosed in writing at your deposition trial.

In order for a jury to hear your opinions at trial, your opinions must be reliable. In federal court, expert testimony is governed by Federal Rule of Evidence 702, which states:

A witness who is qualified as an expert by knowledge, skill, experience, training, or education may testify in the form of an opinion or otherwise if:

a) the expert’s scientific, technical, or other specialized knowledge will help the trier of fact to understand the evidence or to determine a fact in issue;

b) the testimony is based on sufficient facts or data;

c) the testimony is the product of reliable principles and methods; and

d) the expert has reliably applied the principles and methods to the facts of the case.

This means, that if a fact or evidence at issue involves scientific, technical, or specialized knowledge that is outside the scope of an ordinary layman’s experience, or involves complex issues challenging a layman’s comprehension, expert testimony is required. The scientific evidence must not just be relevant but also reliable. Expert opinions will be scrutinized to see if they are based on scientific testing or review of scientific data rather than just assumptions or speculation. Additionally, the experts must be qualified by their knowledge, skill, experience, training, or education. Given these parameters, it should come as no surprise that expert trial testimony is required for all medical malpractice cases.

Some states follow the “new or novel rule” which dictates that expert testimony is only admissible if the methodology or scientific principal on which the opinion is based is sufficiently established to have gained general acceptance in the particular field in which it belongs. This means that the evidence must be generally accepted as reliable in the relevant scientific community. New or novel techniques will be placed under the scrutiny of this standard. Courts will look at papers, books, journals, and case law to make a determination as to the reliability and general acceptance. Failure to meet the requisite standards may render a physician ineligible to testify.

If you are considering acting as an expert witness there are a few basic dos and don’ts to keep in mind:

Do be mindful of your criticism. If testifying in a medical malpractice case, you will be giving sworn testimony as to whether another physician deviated from the standard of care. Be aware that your testimony can later be used against you if your conduct is ever at issue, or if you contradict yourself in another case. Attorneys often look for prior testimony to use when questioning you at deposition and trial.

Do be aware of any applicable professional society guidelines. Many professional societies publish ethical guidelines as it relates to expert medical testimony. Be aware of those and know that you may be asked about them, especially if you are a member of that society.

Do be prepared for basic areas of cross-examination. There are a few tried and true areas that will always be the subject of cross-examination. Any perceived bias you may have, your fees, and whether you do more work for plaintiffs versus defendants are a just few examples. You should also be prepared to be cross-examined on the differences between personal practice (what you do) and an actual deviation from the standard of care.

Do keep written communication to a minimum. All communication between the expert physician and the attorney is potentially discoverable by the other side. The rules differ for state and federal courts. Emails, draft reports, and written questions all cause the creation of unnecessary side issues and areas of cross-examination. The best practice is for all substantive communication to be done by phone.

Do be clear in what you are charging. It is not unusual for an expert to charge one hourly rate for record review, and a different rate for testimony. Your fee schedule should also note that any travel expenses you incur will also be invoiced. Your hourly rate should be appropriate for your area of practice. In our experience, gastroenterologists typically charge $400.00-$600.00 an hour for record review, and $550.00-$700.00 an hour for testimony.

Do not submit an invoice until after your deposition. Submitting invoices before your deposition creates unnecessary cross-examination issues. At the time of retention, speak to the attorney and ask if you will be able to submit invoices as you work. Most attorneys prefer invoices be submitted after your deposition. Because the wheels of justice often turn slowly, you could be waiting an equally long time to submit an invoice and get paid. One way to avoid this dilemma is to require a retainer at the time of retention.

Do not sign up with an expert finder service. Resist the urge to sign up with an expert finder service. The best medical experts come from referrals from other attorneys or physicians. Expert retention via an expert finder service creates the impression that you are a “hired gun” in the business of being a professional expert and can diminish your credibility. The finder services also charge a commission or fee.

As a gastroenterologist, you have the specialized knowledge to provide expert testimony regarding the cause of an injury and extent of damages in cases where you have treated a patient. You also have the type of education and training necessary to serve as an independent expert. Doing so is a serious task that can be time consuming and stressful. However, it can also be rewarding and allow you to make sure a fair and just outcome occurs.

This article is for general informational purposes only. Please consult your own attorney if you have questions. This information is not intended to create an attorney-client relationship.

Mr. Mills is an equity partner at Cunningham, Meyer & Vedrine PC in Chicago. Ms. Lindbert is a partner at Cunningham, Meyer & Vedrine PC. Both focus their practices on defending doctors and hospitals in medical malpractice actions.

Student loan management: An introduction for the young gastroenterologist

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

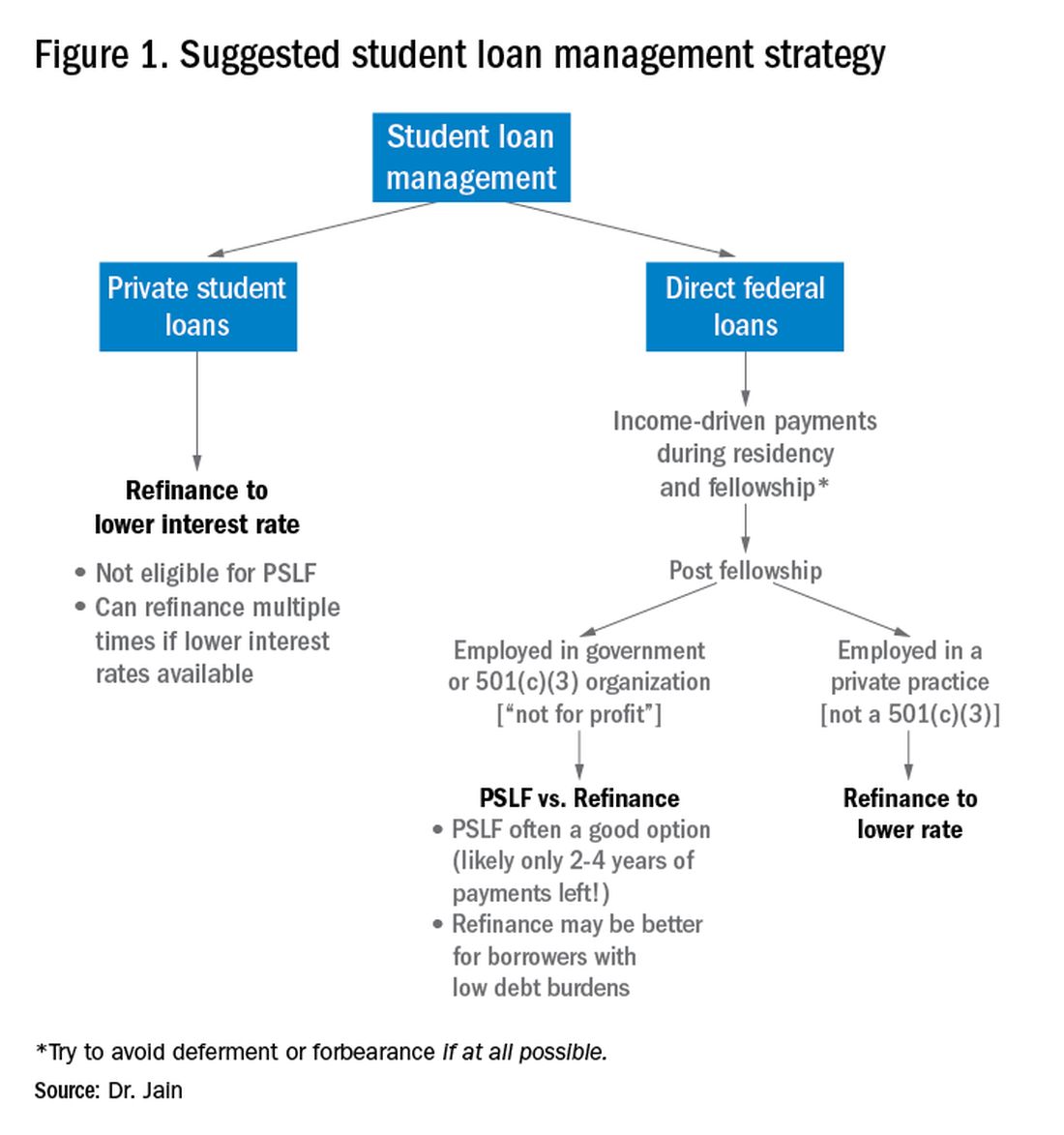

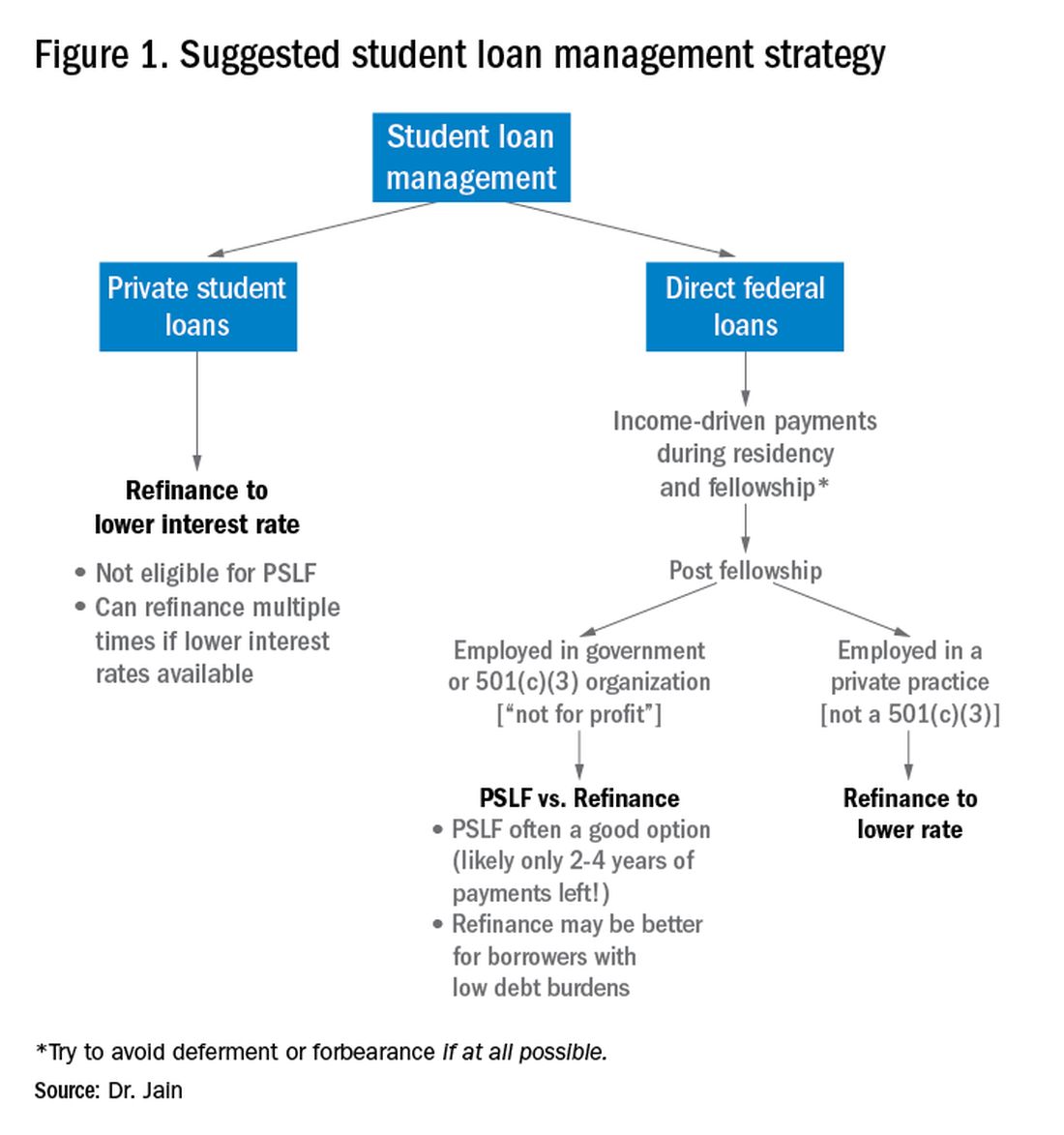

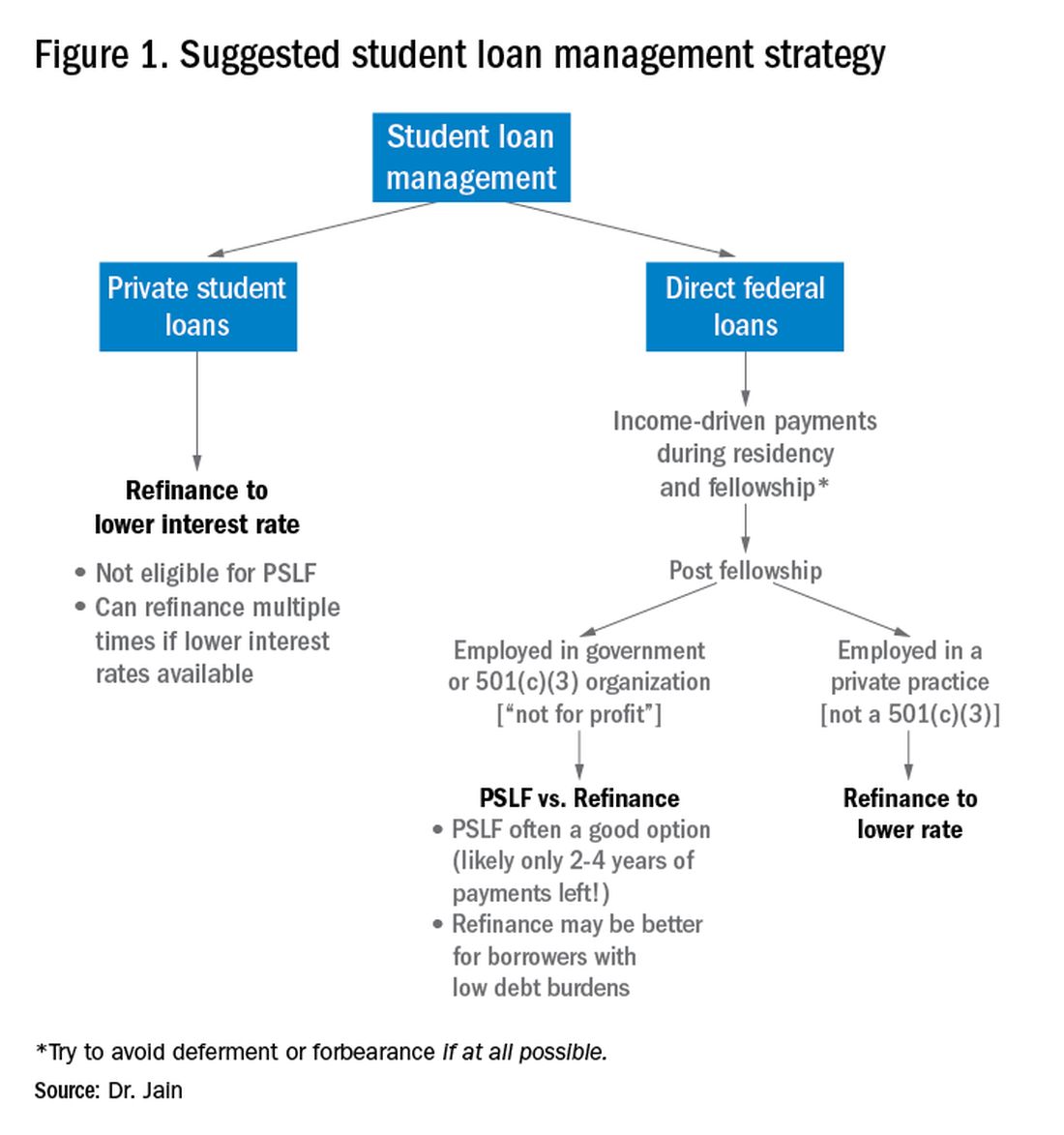

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

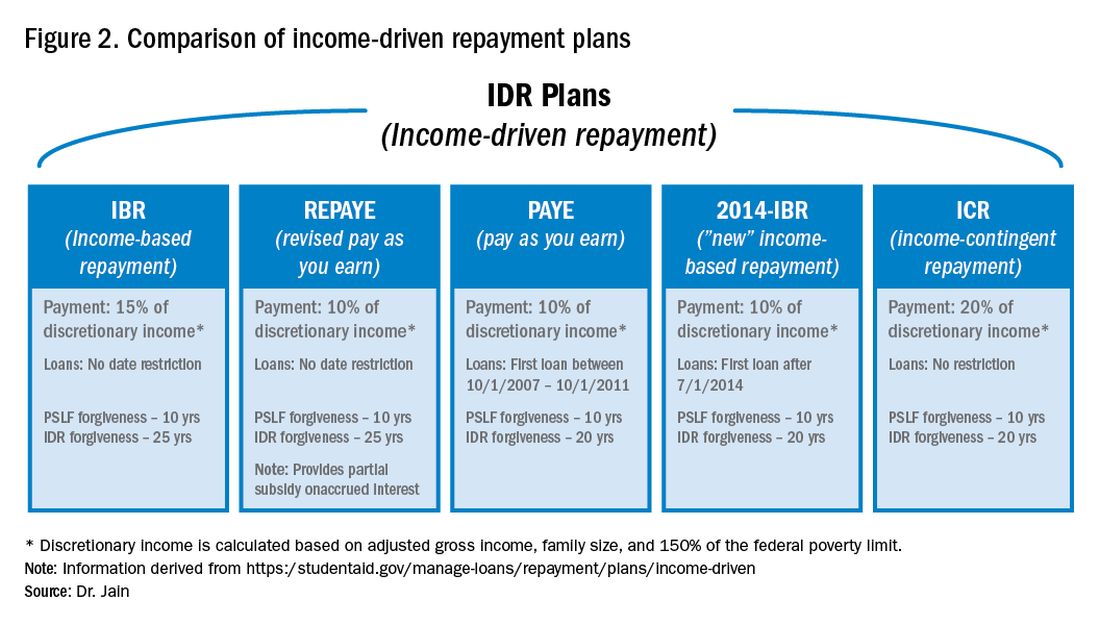

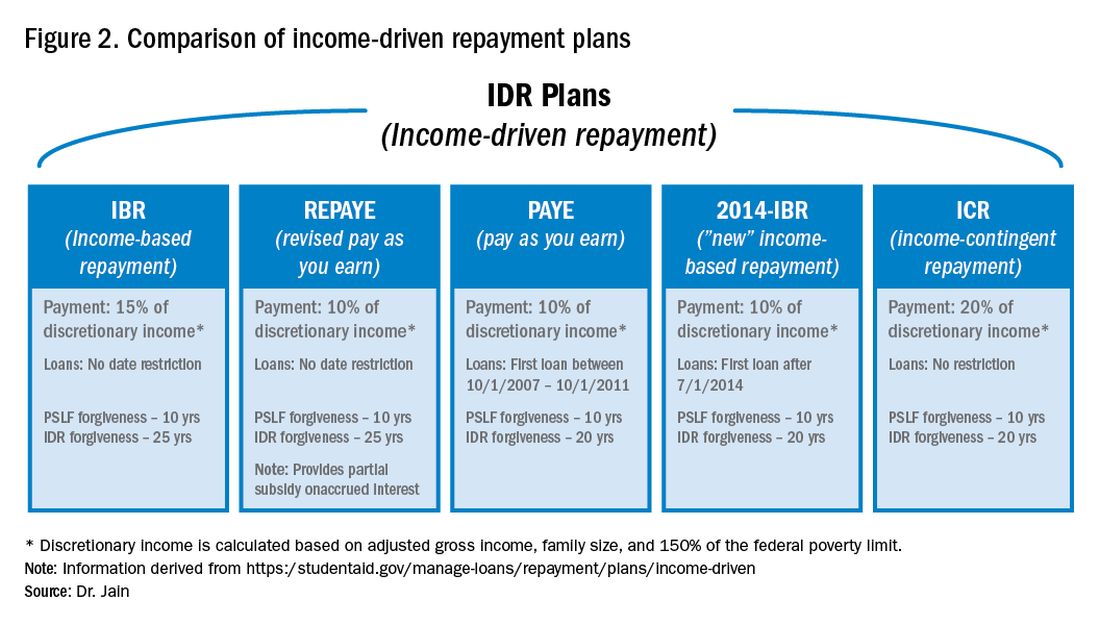

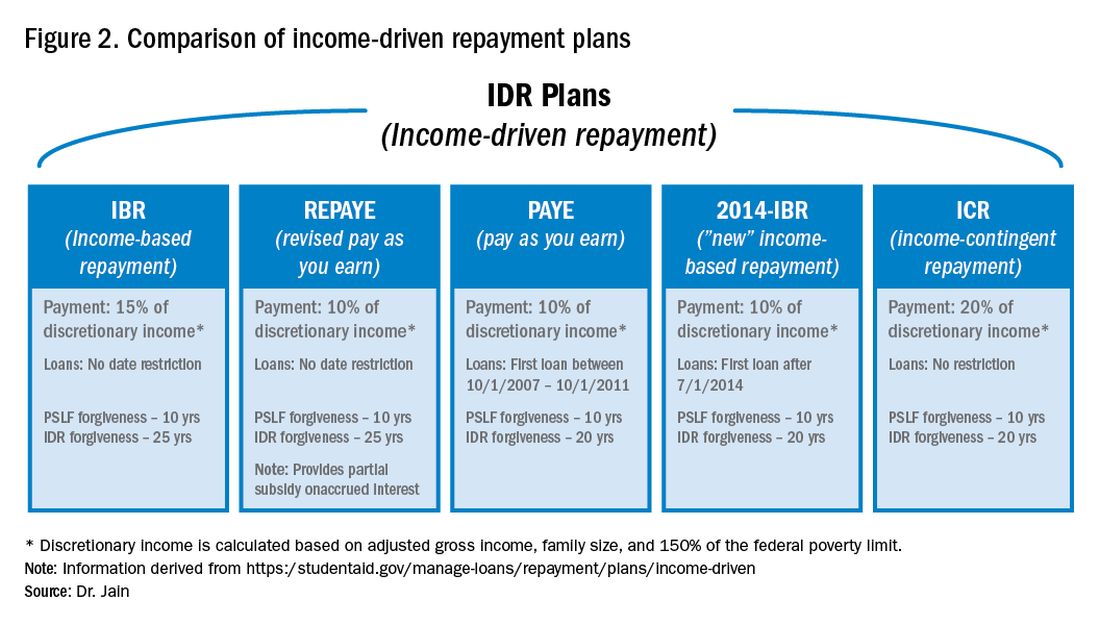

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

Pitfalls in physician-patient communication via patient access support portals

Technology can be used to enhance communication, increase patient safety, and improve overall patient care. For example, many physicians have arranged for remote access to medical records and established a unique system of communication via a patient access support portal. A patient portal is a secure online website that provides patients 24-hour, on-demand access to their health information. Patient portals, while popular and oftentimes quite helpful, are not without drawbacks. Communication by electronic means with your patient can be viewed by some as impersonal and can make patients less tolerant to what they perceive to be a mistake, error, or unwanted outcome. A decrease in face-to-face contact and communication with your patient also gives you less time to resolve any conflict or disagreement. While communication via a patient access support portal has the potential to free up medical staff for direct patient care, such communication also carries liability risk.

Patient access support portal

A physician’s legal responsibility to communicate in a timely and accurate manner does not change, irrespective of the form of communication. However, communication via a patient access portal does have some unique features that must be considered by the practitioner. Practitioners must remember that any communication via the patient portal creates a permanent record, which can and will be used in the event of litigation. For example, when responding to a patient inquiry about a specific complaint, treatment provided, or test result, it will be presumed that the physician had access to the patient’s full medical record and that the full record will be utilized in making a response. Accessing the patient’s chart will leave an audit trail that will provide what is known as metadata, which in the context of electronic medical records, is what allows technicians to verify that the patient record was accessed, and it provides details as to when, and for how long it was accessed. These records are frequently pursued in litigation, so you must understand that parties can often re-create an intricate and accurate timeline of events. While state courts are divided on the issue of whether metadata contained within electronic medical records is discoverable, recent federal court decisions have held that such data is discoverable pursuant to the Federal Rules of Civil Procedure. Thus, once a patient has communicated with you via the portal, you will be responsible for responding in an appropriate and prompt fashion. For these reasons, it is imperative that you create an agreement with your patients as to how the portal will be used and clearly set forth the rules for such use.

Patient portal policies and procedures

In creating patient portal user agreements (See "Sample User Agreement," attached below), it is crucial that an agreement clearly identify the policies and procedures for use. A patient portal user agreement should:

- Set forth the rules and regulations for portal use.

- Include a verification procedure that requires the patients to confirm that they have the legal capacity to consent to the terms of use. This is especially important when treating patients with mental disability, elderly patients with dementia, minors, and any other individuals who may not legally consent.

- Include a verification procedure that requires the patients to confirm that they understand and agree to abide by the user agreement rules.

- Include a detailed list that informs users of the risks and benefits of communicating via the patient portal.

- Stress that communication through the patient portal is for nonemergent matters only.

- Set forth permissible topics for use, such as communicating with the physician or staff, obtaining test results or records, and setting, changing, or canceling appointments.

- Clearly indicate certain topics that should not be discussed via the patient portal, including mental health issues.

- Reiterate that communication via the patient portal is only one option, and that all other standard methods of communication remain available. In doing so, provide office telephone numbers, hotlines, and email addresses for convenience.

- Inform the patients that they should call the office with any questions or concerns regarding use of the patient portal.

- Include a statement that the patient should call 911 or proceed directly to the nearest hospital for any and all urgent or emergent medical matters.

Other considerations

There are, however, equally critical considerations to be made that go beyond the core details of the user agreement. For instance, use of the patient access portal should be limited to only current or active patients, and you should stress to patients the importance of keeping their contact information updated and accurate. This is especially vital in situations in which a patient is unresponsive to communication via the portal, as your staff will need to follow up via other means of communication. It is also imperative to ensure the patient portal is programmed to promptly alert you or your staff following an inquiry from the patient as the patient will likely expect an immediate response.

Notably, communication via the patient portal must still comply with the Health Insurance Portability and Accountability Act (HIPAA). This means that only authorized users are able to access records within the patient portal. To ensure compliance with HIPAA, all users should be instructed in the appropriate practices of maintaining patient privacy. This includes barring the use of shared passwords amongst multiple individuals, requiring that users enable an auto log-off setting, and programming work stations to turn off automatically after brief periods of nonuse. Further, all communications in the patient portal should be encrypted to prevent the patient’s sensitive information from being accessed in the event of an attempted security breach.

Finally, depending upon the practice, there may be instances in which someone other than the patient’s physician would be reading and responding to patient queries. In these situations, the patient should be informed of such potential. This way, if the communication is intended only for the physician, the patient will be afforded the opportunity to call the physician directly rather than communicate via the patient portal.